Bitcoin DCA: A Practical Guide to Smoothing Your Bitcoin Investments

When working with Bitcoin DCA, a strategy of buying a fixed amount of Bitcoin at regular intervals regardless of price. Also known as Bitcoin Dollar Cost Averaging, it helps investors ride out market swings and build a position over time.

The core idea behind Dollar Cost Averaging, investing a set amount on a schedule to avoid timing the market is simple but powerful. Bitcoin, the first and most liquid cryptocurrency provides the asset that DCA works on, letting you accumulate units piece‑by‑piece. By spreading purchases, you automatically buy more when prices dip and less when they surge – a built‑in volatility buffer. This buffering effect is what many investors call Bitcoin DCA in practice. Portfolio diversification Portfolio diversification, the practice of spreading investments across different assets to lower overall risk pairs naturally with Bitcoin DCA. Adding a steady Bitcoin stream to a broader mix of stocks, bonds, or other crypto reduces the impact of any single market move. Likewise, robust risk management Risk management, methods used to identify, assess, and mitigate potential losses benefits from the predictability of a DCA schedule – you know exactly how much capital you’re committing each period, making budgeting and stop‑loss decisions clearer.

Why Use Bitcoin DCA?

First, it removes the emotional roller‑coaster of trying to guess the perfect entry point. Second, the mathematical proof of DCA effectiveness shows that, over long horizons, a systematic buying plan often outperforms a one‑off lump‑sum when markets are volatile. Third, it aligns with the broader themes you’ll see across the articles below: diversification lowers portfolio risk, blockchain immutability keeps your transaction records safe, and real‑world case studies like El Salvador’s Bitcoin adoption illustrate how steady buying can fuel larger ecosystem growth.

Below you’ll find deep dives into diversification, blockchain data integrity, the math behind DCA, and many other angles that together paint a full picture of how a disciplined Bitcoin buying habit can fit into any investment playbook. Dive in to see the tools, strategies, and real‑world examples that will help you decide if Bitcoin DCA is right for you.

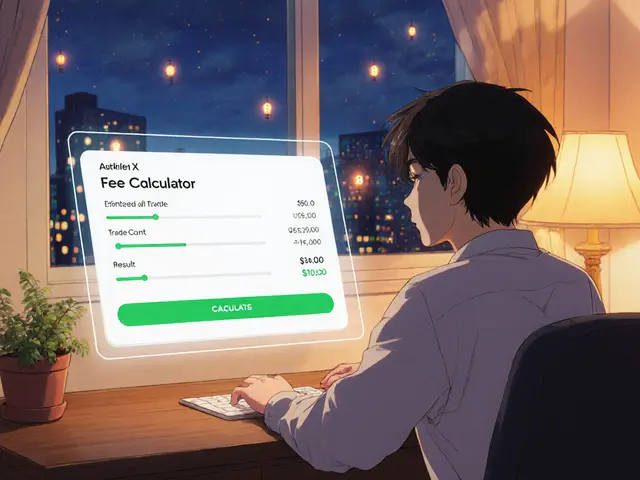

Implementing a Bitcoin DCA Strategy: Step-by-Step Guide

Learn how to set up a Bitcoin Dollar Cost Averaging (DCA) plan step by step, choose the right amount, frequency, platform, and avoid common pitfalls for steady long‑term growth.