Blockchain Finance: How Decentralized Tech Is Changing Money and Markets

When you hear blockchain finance, the use of blockchain technology to manage financial transactions without traditional banks or intermediaries. Also known as decentralized finance, it's not just about crypto wallets—it's about rebuilding how money works from the ground up. This isn’t theory. People in Morocco use crypto to send money home despite the ban. Nigerian exchanges now need SEC licenses. Carbon credits are turning into tradeable tokens on ledgers. And DAOs let token holders vote on how funds are spent—no boardroom required.

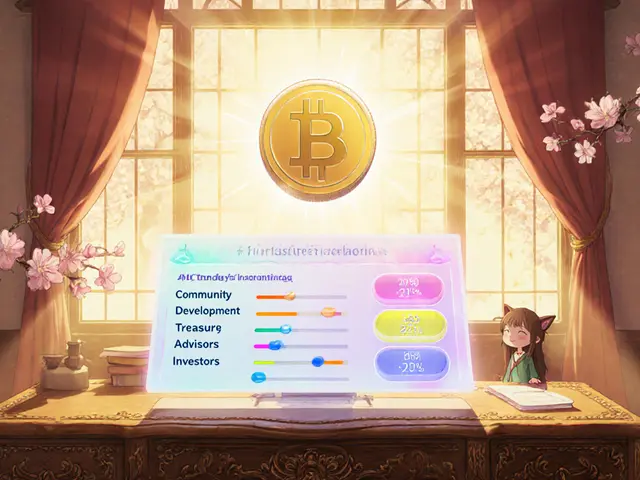

Blockchain finance includes tools like decentralized exchanges, platforms where users trade crypto directly without a central company holding their funds, like CryptoBridge once was—or Shido DEX, which barely functions today. It includes tokenized assets, real-world things like patents, art, or carbon credits turned into digital tokens on a blockchain, letting creators sell directly to anyone, anywhere. It even includes DAO governance, systems where voting power is tied to token ownership, not shares or titles, which is how projects like Minswap or Peanut.Trade once let users decide their own future. But not all of it works. Many tokens—like RENEC or CAKEBANK—have no volume, no team, no purpose. And exchanges like Ankerswap or ZT? They vanish or scam you.

What you’ll find here isn’t a list of hype coins or vague promises. It’s a collection of real cases: what worked, what failed, and why. You’ll see how airdrops like TacoCat or MOWA Moniwar lure people in—and often leave them with worthless tokens. You’ll learn why blockchain IP marketplaces are quietly changing how artists and inventors earn. You’ll understand the hidden risks in DePIN networks and why quantum computing could break Bitcoin’s security in years, not decades. This isn’t about getting rich quick. It’s about knowing what’s real, what’s risky, and what’s just noise in the noise of blockchain finance.

Future of Security Token Markets: How Blockchain Is Rewriting Finance

Security token markets are turning real estate, stocks, and commodities into digital assets backed by blockchain. With institutional adoption rising and regulatory clarity improving, this $250B sector could hit $30T by 2030.