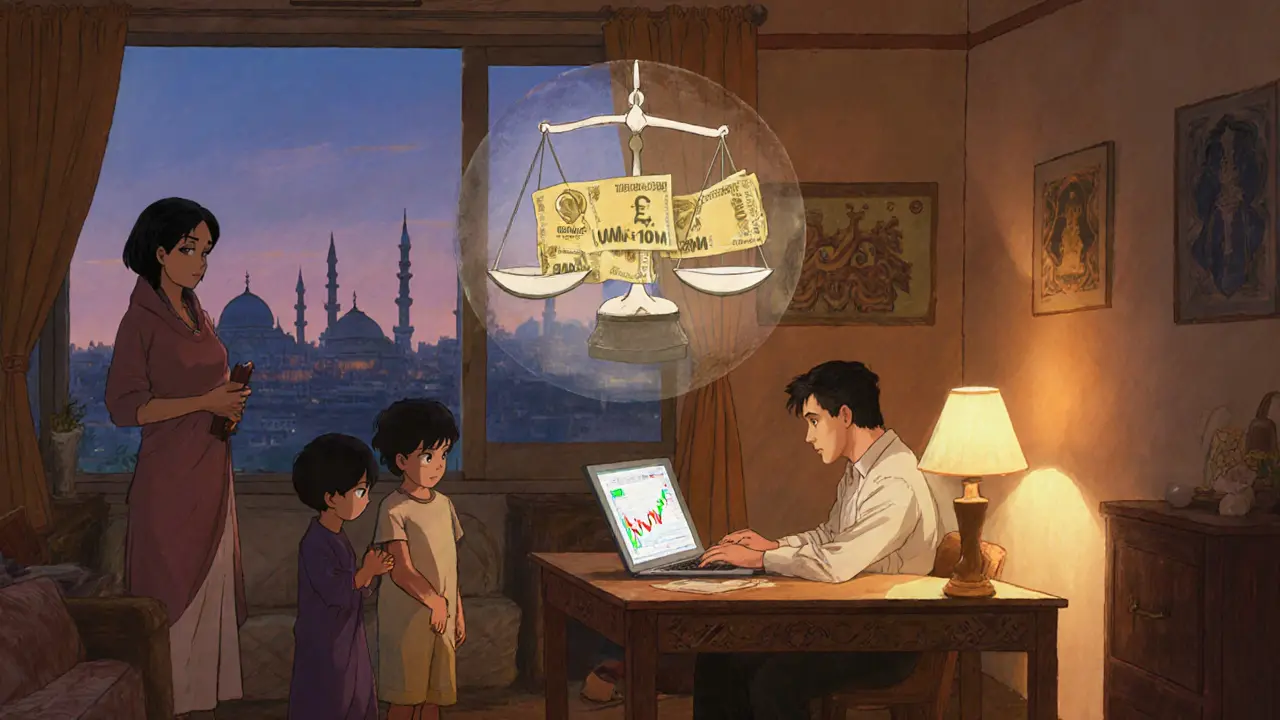

Crypto Trading Penalty Egypt: A Practical Overview

When talking about Crypto Trading Penalty Egypt, the set of fines and sanctions imposed on traders in Egypt who break crypto‑related laws. Also known as Egypt crypto trading fines, it targets activities like unregistered exchange use, illegal token sales, and ignoring anti‑money‑laundering (AML) rules. Crypto regulation in Egypt is overseen by the Egyptian Financial Regulatory Authority (FRA), which issues the penalties and monitors compliance. AML compliance is a core requirement: failing to implement know‑your‑customer (KYC) checks can trigger steep fines or even criminal charges. Understanding the crypto trading penalty Egypt helps you avoid costly mistakes and keeps your trading activity on the right side of the law.

Key Elements of Egypt's Crypto Penalty Framework

The FRA applies three main types of sanctions: monetary fines, trading bans, and, in severe cases, asset seizure. A fine can range from 5,000 to 200,000 Egyptian pounds depending on the violation’s severity and whether the trader cooperated with investigators. The penalty also includes a mandatory compliance audit, which forces the offender to overhaul internal controls within a set period. Moreover, trading bans can last from six months to two years, effectively freezing any crypto activity on the trader’s accounts. These sanctions are linked to broader crypto regulation goals, such as preventing money‑laundering, protecting investors, and aligning with international standards like the FATF recommendations. In practice, the FRA requires every crypto platform operating in Egypt to register, submit regular transaction reports, and enforce strict KYC/AML protocols. Ignoring these duties triggers the penalty system, which the authority uses to maintain market integrity.

So, what can you do to stay clear of the penalty? First, verify that any exchange you use is officially registered with the FRA – the authority maintains a public list of approved platforms. Second, implement robust KYC checks: collect full identification, source‑of‑funds documentation, and perform ongoing monitoring of transaction patterns. Third, keep detailed records of every trade, including timestamps, counterparties, and amounts; these logs are essential if the FRA initiates an audit. Fourth, stay updated on regulatory announcements; Egypt frequently revises its crypto guidelines, especially around new token offerings and DeFi services. Lastly, consider using compliance software that automates AML screening and flagging of suspicious activity – many tools now support Egyptian regulatory thresholds. By treating the penalty framework as a roadmap rather than a hurdle, you can build a resilient trading strategy that meets legal expectations while still capturing market opportunities. Below, you’ll find a curated collection of articles that dive deeper into each aspect, from diversification tactics to real‑world case studies of regulatory enforcement.

Egypt’s 1‑10MillionEGP Fines for Crypto Trading: What the Law Says

Egypt imposes 1‑10millionEGP fines for crypto trading under LawNo.194of2020. Learn the penalties, enforcement agencies, and how the ban clashes with high local crypto use.