Egypt Crypto Ban – Impact, Rules, and What to Watch

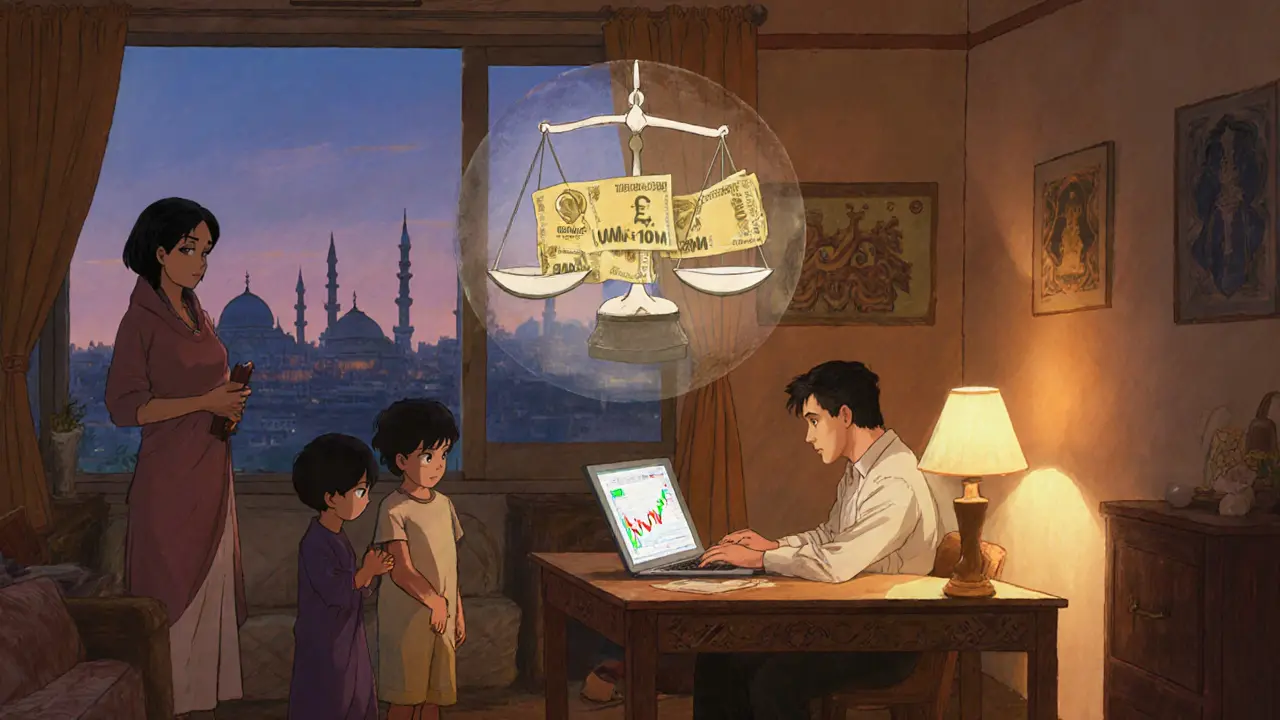

When talking about Egypt crypto ban, the government’s decision to prohibit most cryptocurrency activities within its borders. Also known as Egyptian digital asset crackdown, it encompasses strict limits on buying, selling, and using crypto for payments. This ban requires firms to halt crypto‑related services and forces users to close wallets that interact with local banks. Cryptocurrency regulation in Egypt now mirrors broader financial controls, demanding that every digital‑asset transaction be reported to the Central Bank and that compliance teams monitor suspicious activity. In short, the ban influences market liquidity, pushes traders offshore, and raises questions about future legal pathways for blockchain projects in the country.

Key implications for investors and businesses

The first ripple comes from KYC & AML requirements. Under the new rules, any platform that still wishes to operate must implement rigorous identity verification, transaction monitoring, and reporting mechanisms that match the FATF standards. This means higher onboarding costs, longer verification times, and a need for robust software to flag illicit flows. For investors, the practical effect is a slowdown in entry and exit points – you’ll spend more minutes (or hours) proving who you are before you can trade, and you may find fewer local exchanges willing to list crypto assets at all. Meanwhile, crypto exchange restrictions tighten the funnel. Banks are barred from processing crypto‑related payments, and licensed financial institutions face penalties for even indirect exposure. The result is a shrinking pool of liquidity providers, which can widen spreads and increase slippage for anyone trying to move funds. Companies that previously relied on crypto for cross‑border payments now scramble for alternative corridors, often turning to traditional remittance services that charge higher fees. In practice, this pushes both retail and institutional players to look at offshore solutions or to restructure their operations around fiat‑only channels. The broader picture also includes the rise of global crypto bans. Recent moves in Kazakhstan, Argentina, and even the Taliban‑ruled regions show a pattern: governments reacting to energy concerns, capital flight, or ideological stances. Each of those bans offers a lesson for Egypt – the importance of clear policy communication, the need for transition frameworks, and the impact on investor confidence. By comparing Egypt’s approach with the Kazakhstani power‑grid crackdown or Argentina’s banking restrictions, you can see how regulatory intensity often correlates with market volatility and the speed of capital outflows.

All of these pieces – strict regulation, heavy KYC/AML, limited exchange access, and the global context – weave together to shape what you’ll experience on the ground. Below you’ll find a curated set of articles that break down each facet in plain language: from how to stay compliant under the new rules, to strategies for diversifying risk when local crypto options disappear, and even case studies of other countries’ bans that can inform your next move. Armed with this insight, you’ll be better prepared to navigate the shifting landscape, protect your assets, and spot opportunities that arise when markets adjust to new legal realities.

Cross-Border Crypto Transfers from Egypt: Legal Risks and Real-World Consequences

Cross-border crypto transfers from Egypt are illegal under Law No. 194 of 2020, with penalties including fines up to $213,000 and imprisonment. Despite this, millions use crypto to survive economic collapse, creating a dangerous underground market.

Egypt’s 1‑10MillionEGP Fines for Crypto Trading: What the Law Says

Egypt imposes 1‑10millionEGP fines for crypto trading under LawNo.194of2020. Learn the penalties, enforcement agencies, and how the ban clashes with high local crypto use.