Law No. 194 of 2020 – What It Means for Crypto and Finance

When dealing with Law No. 194 of 2020, Indonesia's comprehensive legal framework that governs digital assets, fintech services and market integrity. Also known as the 2020 Crypto Law, it sets the rules for licensing, consumer protection and enforcement. Right alongside it, cryptocurrency regulation, the set of statutes that define how digital tokens can be issued, traded and reported works hand‑in‑hand with AML compliance, mandatory anti‑money‑laundering procedures that require KYC checks, transaction monitoring and suspicious‑activity reporting. These three entities form the core of the legal landscape we’ll be unpacking.

Key Areas Covered by Law No. 194 of 2020

The law breaks down into several practical pillars. First, digital asset tax, the tax regime that obliges traders and businesses to declare crypto gains, pay capital‑gain tax and abide by withholding rules ensures the government captures revenue from booming markets. Second, the fintech law, regulations that cover payment‑service providers, e‑wallets and peer‑to‑peer platforms expands oversight beyond just tokens to all digital financial services. Together they create a compliance chain: Law No. 194 of 2020 mandates AML reporting for crypto exchanges, AML then drives tax reporting, and fintech licensing ties everything to consumer protection.

These relationships matter for anyone trading, developing or investing in digital assets. For example, a crypto exchange that wants to operate in Indonesia must first obtain a licence under the fintech law, then install KYC/AML tools that satisfy the AML compliance standards, and finally integrate tax‑reporting modules that honor the digital asset tax rules. If any link in that chain is missing, the business faces fines, license revocation or even criminal charges. That cause‑and‑effect chain appears across many of our articles – from global KYC/AML guides for 2025 to country‑specific restrictions in Argentina, India and beyond.

Beyond the technicalities, the law also pushes the industry toward greater transparency. By requiring real‑time transaction monitoring, it discourages illicit flows that might otherwise hide behind anonymity. It also opens the door for institutional investors who need clear legal certainty before allocating capital. In practice, you’ll see this reflected in the rise of compliant exchanges, audit‑ready DeFi protocols and tax‑optimised trading strategies – topics we cover in depth in the posts below.

What you’ll find in the collection that follows is a mix of practical how‑tos and strategic overviews. We dive into KYC/AML requirements for 2025, compare crypto exchange restrictions across jurisdictions, explain how the El Salvador Bitcoin experiment fits within broader regulatory trends, and unpack the impact of energy‑grid crises on mining policy. All of these pieces tie back to the core principles set out in Law No. 194 of 2020, giving you a panoramic view of how regulation shapes the crypto ecosystem today.

Ready to see how these rules play out in real‑world scenarios? Scroll down to explore the detailed guides, case studies and expert analyses that will help you navigate the regulatory maze with confidence.

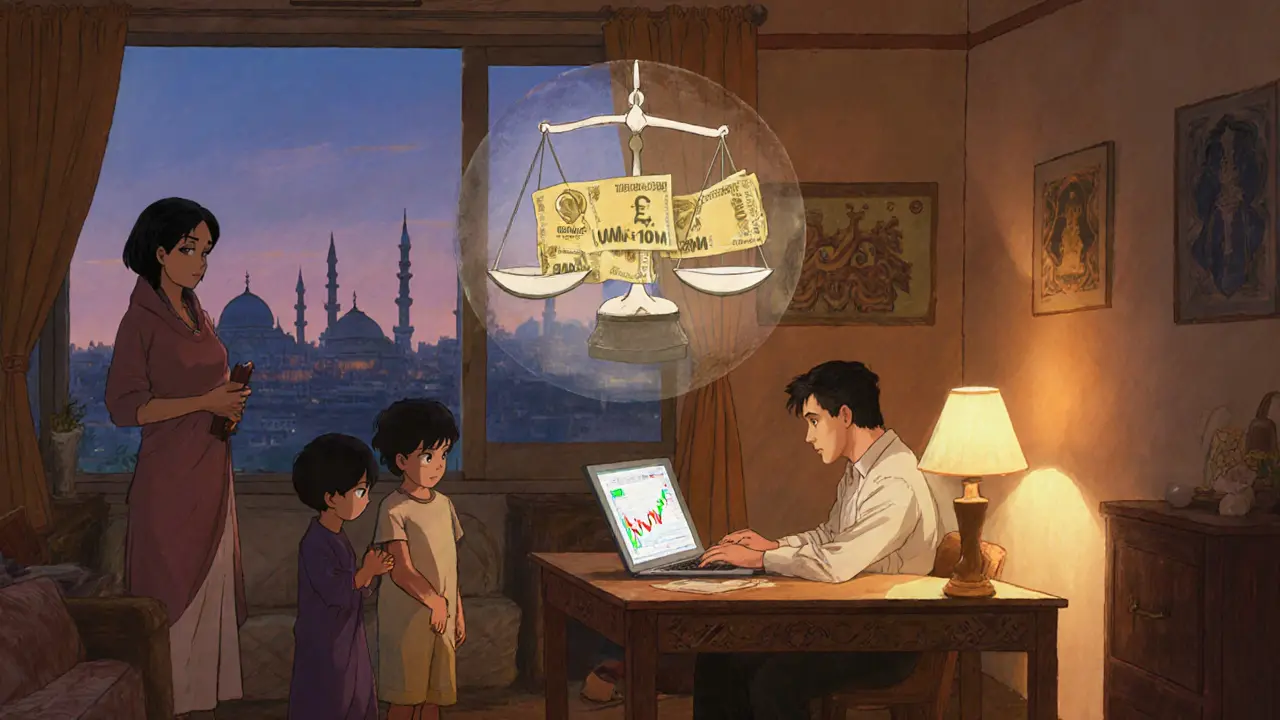

Egypt’s 1‑10MillionEGP Fines for Crypto Trading: What the Law Says

Egypt imposes 1‑10millionEGP fines for crypto trading under LawNo.194of2020. Learn the penalties, enforcement agencies, and how the ban clashes with high local crypto use.