RVLVR Tokenomics: What You Need to Know

When studying RVLVR tokenomics, the economic design behind the RVLVR cryptocurrency, including its supply, distribution, and utility model. Also known as RVLVR token economics, it sits at the intersection of blockchain, a decentralized ledger that records every transaction and cryptocurrency, digital money that relies on cryptographic security. Understanding these three entities together lets you see how token supply rules shape market behavior and investor incentives.

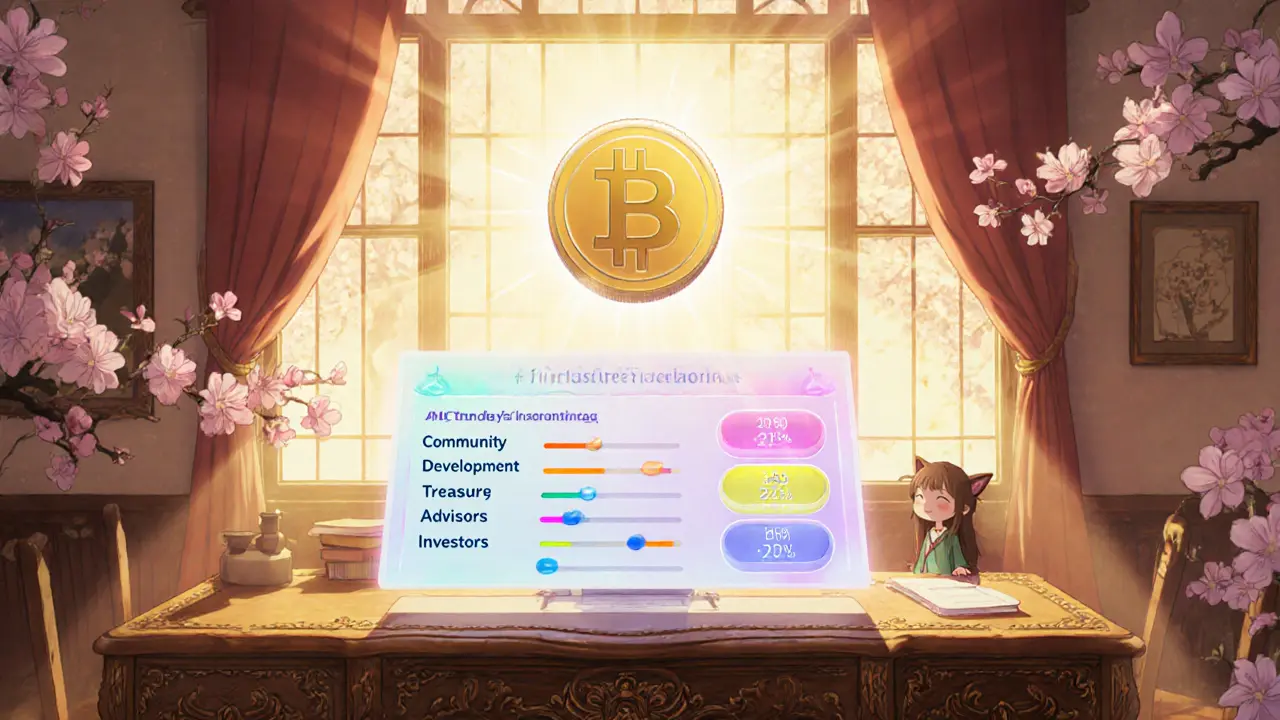

At its core, RVLVR tokenomics encompasses the total circulating supply, the vesting schedule for founders, and the allocation for community rewards. The token uses a fixed‑supply model of 100 million units, with 40% earmarked for liquidity pools, 25% for staking incentives, 15% for development, and the remaining 20% for strategic partnerships. This allocation requires a clear governance framework to prevent sudden dumping and to keep price stability. The governance layer, built on‑chain, lets token holders vote on fee adjustments, new feature rollouts, and ecosystem grants.

Why Supply Mechanics Matter

Supply mechanics are not just numbers; they drive real‑world decisions. For RVLVR, the vesting period for the team spans three years, with a cliff after the first six months. This influences market sentiment because investors can see a gradual release rather than a massive influx that could crash prices. Meanwhile, the staking pool rewards are calculated using a decay function that reduces payouts by 5% each quarter, aligning long‑term holding with decreasing inflation. These rules connect tokenomics to user behavior, encouraging holders to stay engaged and support network security.

The utility side of RVLVR adds another layer of value. Tokens can be used to pay transaction fees on the RVLVR network, access premium DeFi services, and participate in liquidity mining programs. Because each use case burns a fraction of the token, the circulating supply slowly contracts, creating a deflationary pressure that can boost price over time. This deflationary element ties back to the blockchain’s consensus mechanism, where fee burning helps maintain network integrity while rewarding validators.

Finally, market dynamics round out the picture. RVLVR’s price is affected by external factors like overall crypto sentiment, regulatory news, and competing projects. However, the internal tokenomics model—supply caps, vesting, staking rewards, and fee burning—provides a predictable baseline that investors can analyze. By grasping how these pieces fit together, you’ll be better equipped to assess risk, spot opportunities, and make informed decisions when navigating the RVLVR ecosystem. Below, you’ll find a curated selection of articles that break down each of these components in detail, offer real‑world examples, and guide you through practical steps for using RVLVR tokens effectively.

RVLVR (Revolver Token) Airdrop Details: How to Claim, Eligibility & Tokenomics

Learn everything about the RVLVR airdrop: eligibility, claim steps, tokenomics, security tips, and post‑airdrop actions for Revolver Token.