Diversification Risk Calculator

Calculate how diversification reduces portfolio risk by entering your asset allocations and correlation coefficients.

When markets swing like a roller‑coaster, the biggest fear for any investor or business owner is a single shock wiping out years of hard‑earned gains. The antidote isn’t a crystal ball - it’s a disciplined plan that spreads exposure so that a tumble in one corner is balanced by stability elsewhere.

Key Takeaways

- True risk diversification mixes assets that move independently, lowering the chance of a big loss.

- Asset allocation, geographic reach, product lines, and supplier variety each add a layer of protection.

- Low or negative correlation between holdings is the engine that makes diversification work.

- Regular monitoring and rebalancing keep the risk‑spread effective as markets shift.

- Emerging tools - ESG screens, alternative assets, AI‑driven analytics - expand the diversification toolbox.

Below you’ll find a step‑by‑step guide, real‑world examples, and a quick comparison table that shows why a diversified approach consistently outperforms a concentrated one.

What Is Diversification?

Diversification is the practice of allocating capital across a variety of assets, markets, and operational activities to lower the total risk of a portfolio or business. The idea dates back to early modern finance, but the core logic remains simple: not all pieces of the puzzle react the same way to economic news, policy shifts, or natural events.

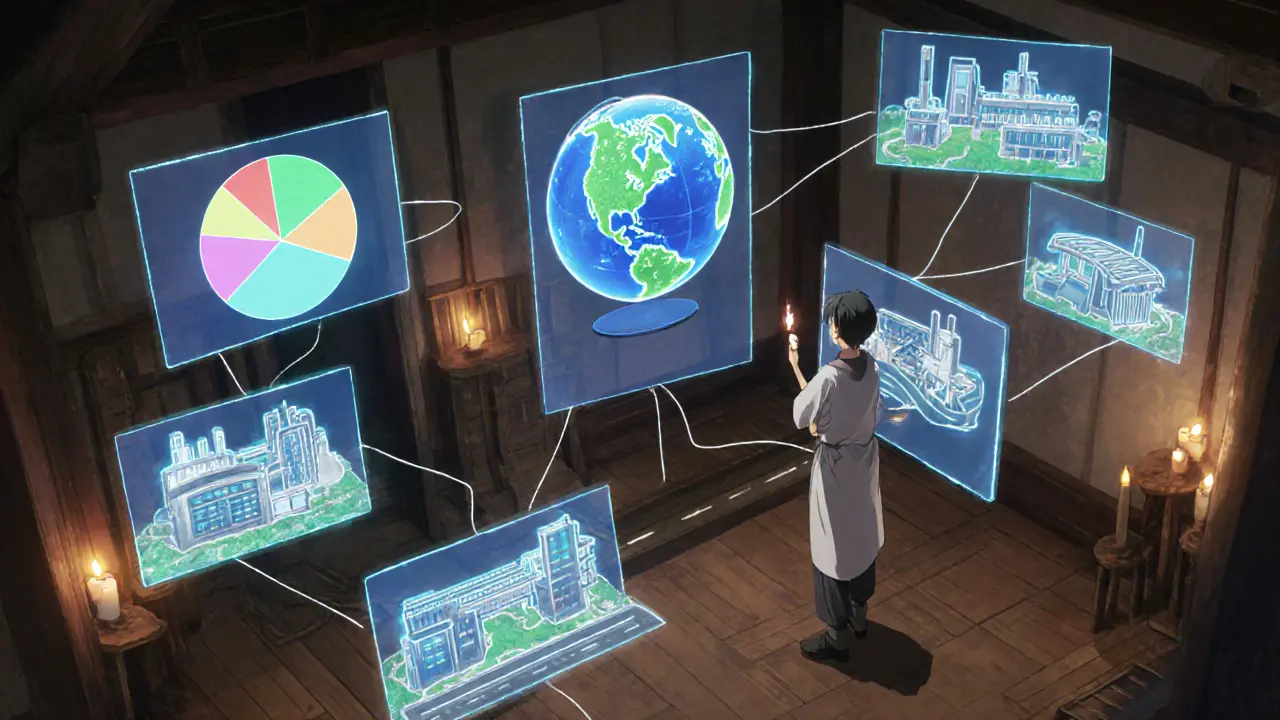

Core Components That Build a Robust Diversified Strategy

Each pillar adds a dimension of independence, and together they create a risk‑reduction network.

- Asset allocation is the distribution of funds among major asset classes such as equities, bonds, real estate, and commodities. It sets the primary risk floor.

- Geographic diversification is investing or operating in multiple regions to avoid concentration in any single country’s economic cycle, shielding you from local recessions or political upheaval.

- Product diversification is offering a range of goods or services so that a dip in demand for one line doesn’t cripple revenue.

- Supplier diversification is sourcing key inputs from several vendors to prevent supply‑chain interruptions.

- Operational diversification is engaging in different business activities or sectors, spreading operational risk across multiple cash‑flow sources.

Why Correlation Matters

The math behind diversification rests on correlation is a statistical measure that shows how two variables move in relation to each other, expressed as a coefficient between -1 and +1. When two assets have a correlation close to +1, they rise and fall together - offering little risk relief. A coefficient near 0 means the assets move independently, and a negative value means they often move in opposite directions, delivering the strongest cushion.

Portfolio theory shows that mixing low‑correlated holdings reduces the variance of the combined return, which translates directly into lower risk exposure.

Benefits You’ll See in Practice

- Risk reduction: A well‑balanced mix can cut the chance of a single‑event loss by more than half, according to actuarial studies.

- Smoother returns: When one asset lags, another may be gaining, flattening the performance curve.

- Better risk‑adjusted returns: Metrics like the Sharpe ratio improve because you’re earning similar or higher returns for a smaller risk base.

- Volatility shield: Safe‑haven assets such as high‑quality bonds or gold often rise when equities tumble, acting as a buffer.

- Long‑term growth: Compounding works more efficiently when losses are limited, allowing wealth to accumulate faster over decades.

Concentrated vs. Diversified: A Quick Comparison

| Aspect | Concentrated Portfolio | Diversified Portfolio |

|---|---|---|

| Number of holdings | 5-10, often within one sector | 30+ across multiple asset classes and regions |

| Correlation level | High (often >0.8) | Low to negative (average <0.3) |

| Risk of large loss | High - single event can wipe out most value | Moderate - losses in one area offset by gains elsewhere |

| Return volatility | Very volatile, swings of >15% common | Smoothed, typical swings <7% annually |

| Typical Sharpe ratio | 1.0-1.5 (risk‑heavy) | 1.8-2.5 (more efficient) |

How to Build a Diversified Portfolio - Step‑by‑Step

- Assess current exposure: List every investment, product line, or supplier and note the asset class, geography, and sector.

- Identify concentration risks: Highlight items that make up more than 10‑15% of total value or share the same risk driver.

- Define target allocations: Use a strategic mix (e.g., 40% equities, 30% bonds, 15% real estate, 10% commodities, 5% cash) that matches your risk tolerance.

- Choose low‑correlation assets: Run a correlation matrix (available in most brokerage platforms) and select holdings that score below 0.4 with existing positions.

- Spread geographically: Add exposure to developed markets (US, EU) and emerging economies (India, Brazil) to capture different growth cycles.

- Incorporate alternative investments: Private equity, infrastructure, or ESG‑focused funds can add an extra layer of independence.

- Implement supplier and product variety: For businesses, negotiate contracts with at least two vendors per critical input and launch a secondary product that serves a different customer segment.

- Set rebalancing rules: Decide on a threshold (e.g., 5% drift) or a calendar (quarterly) to bring the portfolio back to target weights.

Monitoring and Adjusting Over Time

Even the best‑designed mix can drift as markets move. A disciplined monitoring routine includes:

- Quarterly review of asset performance and correlation updates.

- Annual stress‑test: model how the portfolio would fare under a 10% market drop, a commodity shock, or a currency devaluation.

- Adjustment triggers - if a holding’s correlation rises above 0.5, consider swapping it for a more independent asset.

Technology helps. Modern platforms now offer AI‑driven alerts that flag correlation shifts in real time, letting you act before a risk builds up.

Emerging Trends Expanding the Diversification Toolbox

Today’s investors have more options than ever. Three developments are reshaping how risk is spread.

- ESG integration is adding environmental, social, and governance criteria as a separate asset class, providing both ethical alignment and a new source of low‑correlation returns.

- Alternative investment platforms are online services that give retail investors access to private real estate, infrastructure funds, and venture‑stage deals once reserved for institutions.

- Artificial‑intelligence analytics are machine‑learning models that process billions of data points to predict changing correlations and recommend dynamic rebalancing.

Each of these expands the pool of low‑correlated assets, further insulating portfolios from singular shocks.

Common Pitfalls to Watch Out For

Even seasoned investors slip up. Avoid these mistakes:

- Assuming more assets always means better diversification - the key is low correlation, not sheer quantity.

- Neglecting hidden concentration, such as multiple holdings that share the same supplier or regulatory risk.

- Over‑rebalancing - moving in and out of positions too often can erode returns through transaction costs.

- Ignoring liquidity - some alternative assets look great on paper but can be hard to sell when you need cash.

Frequently Asked Questions

How many asset classes should a typical investor hold?

A solid base includes at least four major classes - equities, bonds, real estate, and commodities - then you can layer alternatives or ESG funds based on risk tolerance.

Does diversification eliminate all risk?

No. Systematic or market‑wide risk still affects all holdings, but diversification trims the impact of any single event.

What’s the difference between geographic and sector diversification?

Geographic diversification spreads exposure across countries and regions, while sector diversification spreads across industry categories such as technology, healthcare, or energy.

How often should I rebalance my portfolio?

Most advisors recommend a quarterly check or a trigger‑based approach - for example, when any holding drifts more than 5% from its target weight.

Can I achieve diversification with a single mutual fund?

Broad index funds or multi‑asset ETFs can provide a good baseline, but adding separate holdings (e.g., a commodity ETF or a small‑cap international fund) usually improves the low‑correlation mix.

By treating diversification as a continuous process rather than a one‑time checklist, you turn risk management into a competitive advantage. The result? Fewer sleepless nights when markets wobble and a smoother path toward long‑term wealth.

Write a comment

Your email address will be restricted to us