Pakistan Bitcoin Mining Profit Calculator

Calculate Your Bitcoin Mining Profit

Use Pakistan's subsidized electricity rate of $0.08/kWh to estimate potential profits from Bitcoin mining. This calculator helps you understand if mining in Pakistan could be profitable for your setup.

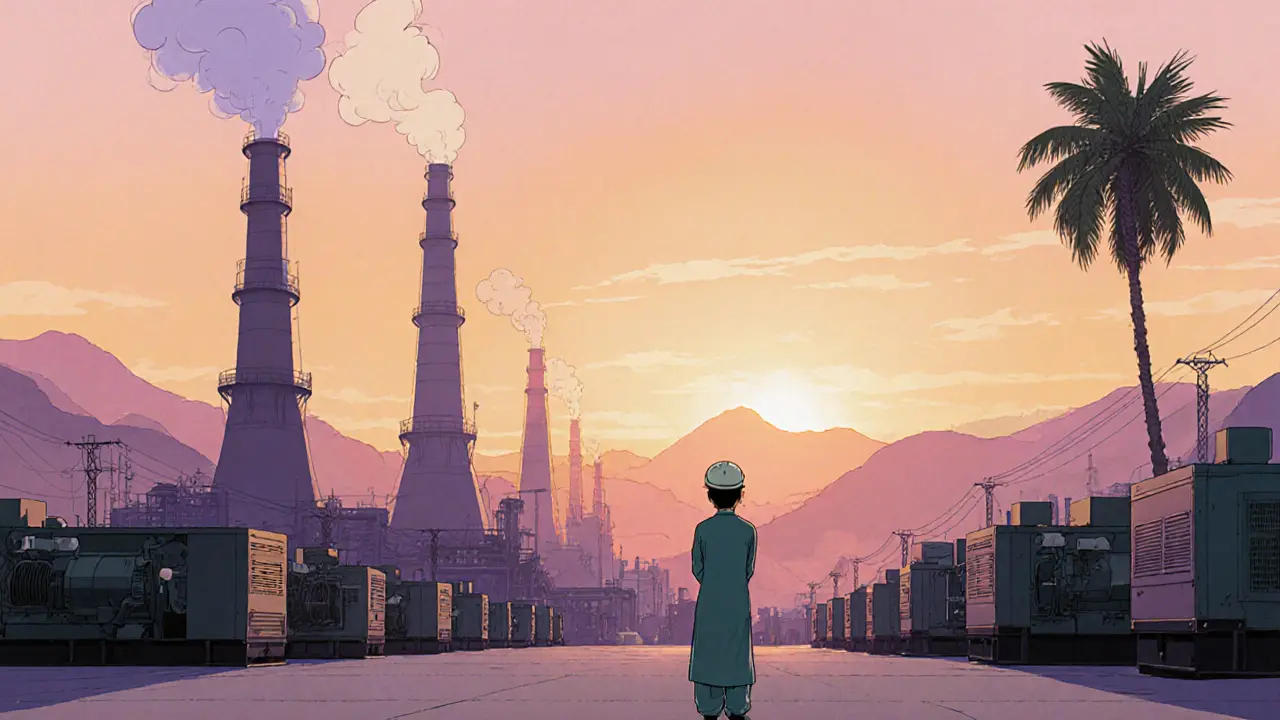

Pakistan just announced a bold plan: 2,000 megawatts of surplus electricity will be earmarked exclusively for Bitcoin mining and AI data centres. Pakistan crypto mining could turn idle power plants into a $1.8 billion revenue stream, but the move also raises red‑flags around subsidies, IMF negotiations, and grid stability. Let’s break down what the allocation really looks like, who’s involved, and what you should watch if you’re a miner, investor, or policy watcher.

Why Pakistan Has a Power Glut

Most countries wrestle with electricity shortages; Pakistan’s paradox is the opposite. The national grid can produce roughly 20,000 MW, but only about 13,000 MW is actively used. That leaves around 7,000 MW of “surplus” capacity - essentially idle generators that still incur fuel, maintenance, and staffing costs. Coal plants, for example, run at a meagre 15 % of their design output, burning fuel for little return.

That idle capacity translates into a financial drain of about 2.8 trillion Pakistani rupees per year. The government’s answer: find a high‑energy‑intensity use that can soak up the excess without compromising residential supply. Crypto mining, with its massive electricity appetite and growing profitability, fits the bill.

What the 2,000 MW Allocation Actually Means

Pakistan crypto mining initiative is a government‑backed program that designates 2,000 MW of surplus power for Bitcoin mining and AI data‑centre operations. The allocation equals about 28.5 % of the country’s total surplus capacity and is managed by the Pakistan Crypto Council (PCC), a new body under the Ministry of Finance. The plan was unveiled at the Bitcoin 2025 conference in Las Vegas, with Finance Minister Muhammad Aurangzeb and Special Assistant on Blockchain Bilal Bin Saqib fronting the announcement.

The government proposes a subsidised rate of 23‑24 PKR per kilowatt‑hour (≈ $0.08/kWh). By comparison, global mining rates hover between $0.03 and $0.15/kWh, depending on location and energy mix. If the projected yield of 17,000 BTC per year holds, that translates to roughly $1.8 billion at current Bitcoin prices - a sizable slice of the $5.6 billion global mining market projected for 2028.

Economic Projections and Job Creation

- Annual revenue: $500 million‑$1 billion from mining fees, equipment leasing, and ancillary services.

- Direct employment: 5,000‑7,000 skilled jobs in mining operations, data‑centre management, and grid monitoring.

- Indirect impact: Boost to local hardware suppliers, telecoms, and renewable‑energy firms seeking to partner on off‑grid projects.

Beyond raw numbers, the initiative aims to position Pakistan as a “digital bridge” between Asia, Europe, and the Middle East - a strategic advantage for data‑centre providers looking to serve multiple regions from a single hub.

Regulatory Landscape and IMF Concerns

International Monetary Fund (IMF) has expressed reservations about the subsidy structure. IMF staff warned that prolonged below‑market rates could distort competition and hurt the broader private‑sector electricity market. They are pushing for a clear exit strategy that phases the subsidy back to market prices once the project demonstrates fiscal viability.

Pakistan’s first crypto‑policy framework, released in April 2025, already sets baseline AML/KYC requirements aligned with FATF standards. The government is also negotiating to move off the FATF “grey list”, a step critical for attracting foreign mining operators who need clear compliance pathways.

Key Stakeholders and Their Roles

Understanding who does what helps you gauge the project's stability:

- Pakistan Crypto Council - coordinates power allocation, licences, and foreign investment.

- Finance Minister Muhammad Aurangzeb - political champion, responsible for budgeting the subsidy.

- Power Division (representative Khan) - assures grid reliability and supervises load‑balancing during mining peaks.

- Changpeng Zhao - Binance co‑founder, serves as strategic adviser, bringing industry expertise and potential partner networks.

- Local telecom operators (PTCL, Multinet, Chapal, Supernet, Cybernet, Vision Telecom) - host AI data‑centres and provide backbone connectivity.

- International mining firms - expected to bring hashing hardware, technical know‑how, and capital.

Risks, Challenges, and Mitigation Strategies

- Subsidy sustainability: If IMF pressure leads to a rapid rate hike, miners may repatriate equipment. Mitigation: phased rate adjustment tied to revenue milestones.

- Grid stability: Sudden spikes in demand could stress transmission lines. Mitigation: real‑time load‑balancing, smart‑grid integration, and reserve margins.

- Regulatory compliance: FATF‑aligned AML/KYC processes add operational overhead. Mitigation: standardized onboarding platforms and collaboration with local banks.

- Environmental concerns: Coal‑heavy power mix raises carbon‑footprint questions. Mitigation: incentivise renewable‑energy contracts, especially solar projects like the 1 MW Turbat installation.

- Political volatility: Shifts in government could alter policy direction. Mitigation: multi‑year contracts with dispute‑resolution clauses.

How Miners Can Get Involved

If you run a mining operation or are looking to start one, here’s a quick checklist to navigate Pakistan’s ecosystem:

- Secure a licence from the Pakistan Crypto Council - applications are accepted on a rolling basis.

- Partner with a local data‑centre or telecom provider for colocation and connectivity.

- Negotiate a power purchase agreement (PPA) at the subsidised 23‑24 PKR/kWh rate, ensuring a clause for future rate adjustments.

- Implement AML/KYC compliance modules that meet FATF guidance - many providers offer turnkey solutions.

- Plan for hardware cooling and backup power, especially if you tap into coal‑based generation.

Quick Comparison of Electricity Costs

| Region | Typical Rate | Pakistan Subsidised Rate | Notes |

|---|---|---|---|

| North America (e.g., Texas) | $0.07 | $0.08 | Similar cost, but higher regulatory scrutiny. |

| Central Asia (Kazakhstan) | $0.02‑$0.04 | $0.08 | Cheaper, but power grid often unstable. |

| Europe (Germany) | $0.30 | $0.08 | Much higher cost, limited competitiveness. |

| Pakistan (Subsidised) | $0.15 (average market) | $0.08 | Government‑backed, subject to IMF renegotiation. |

Future Outlook - Phase 2 and Beyond

Phase 1 focuses on getting the first 2,000 MW online, establishing licences, and proving the revenue model. If the pilot meets its $500 million‑plus annual target and secures IMF approval, the government has hinted at expanding the allocation up to 4,000 MW in Phase 2, possibly adding more AI‑focused data‑centres.

Success could set a precedent for other developing nations with surplus power - think Ethiopia, Nigeria, or even parts of the United States with stranded gas. The upside is massive; the downside is a delicate balancing act between attracting crypto capital and keeping macro‑economic credibility.

Key Takeaways

- Pakistan is turning idle electricity into a crypto‑mining revenue engine, starting with 2,000 MW at a subsidised $0.08/kWh.

- The initiative promises billions in earnings and thousands of jobs but hinges on IMF negotiations and sustainable rate policies.

- Stakeholders range from the Pakistan Crypto Council to global crypto figures like Changpeng Zhao.

- Miners must secure licences, meet FATF‑aligned compliance, and plan for potential rate adjustments.

Frequently Asked Questions

How can foreign miners apply for the 2,000 MW allocation?

Foreign operators submit a licence application to the Pakistan Crypto Council, include a detailed power‑usage plan, and attach proof of AML/KYC compliance. Applications are reviewed within 60 days, after which a power purchase agreement is drafted.

What happens if the IMF forces the electricity subsidy to end?

The government has pledged a phased rate increase tied to revenue milestones. Miners would transition to market rates over 12‑18 months, with a grace period that allows equipment relocation or renegotiation of PPAs.

Is the electricity from renewable sources?

Currently, most of the surplus comes from coal and gas plants, but the government is incentivising solar projects. The University of Turbat’s 1 MW solar plant is a pilot that could be scaled up alongside mining farms.

How does the initiative affect local electricity prices for households?

The plan targets only surplus capacity, so residential supply should remain untouched. However, if subsidies are withdrawn, there could be a modest increase in overall grid operating costs, which might trickle down.

What compliance steps are required to meet FATF standards?

Operators must implement robust KYC checks on all users, maintain transaction monitoring systems, and report suspicious activity to Pakistan’s Financial Monitoring Unit. Third‑party compliance platforms can automate most of these tasks.

Write a comment

Your email address will be restricted to us