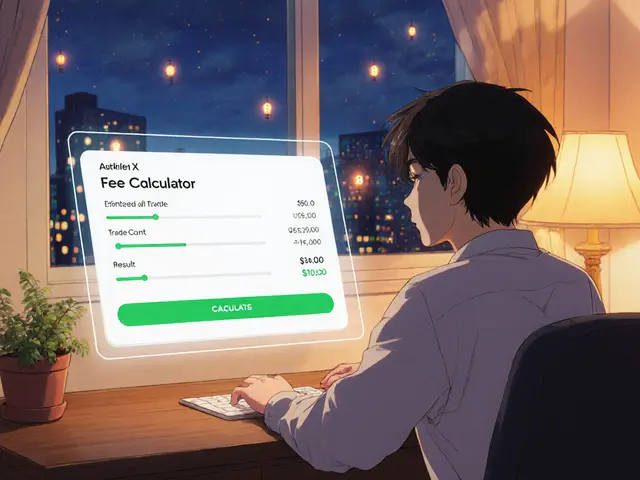

SEC Crypto Penalty Calculator

Calculate Estimated SEC Penalty

How SEC Penalties Work

SEC penalties are calculated based on the severity of the violation, the amount of funds involved, and the number of victims. Under Gensler's enforcement era, penalties were often based on the total value of the fraud. The new approach under Uyeda focuses more on fraud and investor harm than registration issues.

The SEC typically targets the largest violators first and may impose multiple penalties for different violations. The enforcement strategy has shifted from broad regulation to specific fraud targeting.

Enter details above to see your estimated penalty

The U.S. Securities and Exchange Commission (SEC) hit crypto companies with $4.68 billion in fines in 2024 - the largest single-year penalty haul in its history. That’s not a typo. It’s more than the total fines the SEC issued against crypto firms in the previous decade combined. But here’s the twist: the agency filed fewer cases that year. And by mid-2025, it started dropping major lawsuits. What happened?

Why the $4.68 Billion Fine? It Wasn’t Random

The bulk of that $4.68 billion came from one case: Terraform Labs and its founder, Do Kwon. The SEC accused them of running a $40 billion Ponzi-like scheme under the guise of a stablecoin called UST. Investors were promised 20% annual returns. The system collapsed in May 2022, wiping out $40 billion in market value. The SEC didn’t just call it a failure - they called it fraud. And in 2024, they slapped the biggest fine ever on a crypto company: $4.68 billion. That single penalty made up nearly all of the year’s total. But Terraform wasn’t the only target. The SEC also went after Ripple Labs for selling XRP as an unregistered security - a case that had been dragging on since 2020. In 2024, they added $125 million to the total. They went after Telegram for its $1.7 billion token sale back in 2019. And they sued John and JonAtina Barksdale for running a fake ICO that stole $102 million from investors. Each case followed the same pattern: the SEC claimed these were securities, and because they weren’t registered, they broke federal law.The Enforcement Surge Wasn’t About Numbers - It Was About Timing

Here’s what’s odd: the SEC filed 33 crypto enforcement actions in 2024. That’s 30% fewer than in 2023. So how did they collect more money with fewer cases? They went after bigger fish. And they waited. Half of those 33 cases were filed in September and October 2024 - right before the presidential election. That wasn’t coincidence. It was strategy. The SEC, under Chair Gary Gensler, had spent two years building a legal framework to treat almost every crypto token as a security. By the end of 2024, they had enough cases lined up to make a statement: if you’re in crypto, you’re on notice. Gensler’s approach was simple: use the Howey Test - a 1946 Supreme Court ruling on investment contracts - to classify crypto tokens as securities. If a token’s value depends on the efforts of others (like a company’s team), then it’s a security. That meant most tokens on exchanges like Coinbase, Binance, and Kraken were technically unregistered. The SEC didn’t need new laws. They just applied old ones harder than ever.The Gensler Era: $6.05 Billion in Penalties

Gary Gensler became SEC Chair in April 2022. By the time he left in January 2025, his team had collected $6.05 billion in crypto fines. That’s nearly four times what the previous chair, Jay Clayton, collected in his entire term. Under Gensler, the SEC created a special unit called the Crypto Assets and Cyber Unit. It grew from 15 lawyers to over 60. They didn’t just file lawsuits - they went after individuals. Executives were named as defendants. Personal assets were frozen. One executive even had to forfeit a $1.2 million yacht. The message was clear: if you’re running a crypto project, you’re personally on the hook. The industry pushed back. Coinbase sued the SEC in June 2023, calling their enforcement tactics “regulation by enforcement.” Binance settled with the Justice Department for $4.3 billion in 2023 - a separate but related case. The message from the top was consistent: the SEC wasn’t trying to kill crypto. They were trying to control it. And they were willing to use every tool they had to do it.

The Sudden Shift: What Happened After Gensler Left

On January 20, 2025, Gary Gensler stepped down. The next day, Acting Chair Mark Uyeda announced a new Crypto Task Force. Its mission? Stop using enforcement as the main tool. Instead, they were going to build rules - not punish violations. The task force was led by Hester Pierce, better known as “Crypto Mom” for her long-standing support of crypto innovation. She had spent years warning that the SEC’s approach was scaring startups away. Mike Selig, a former Wall Street lawyer, joined as Chief Counsel. Together, they started trimming staff. The Crypto Assets and Cyber Unit was replaced with the Cyber and Emerging Technologies Unit (CETU). The number of attorneys focused on crypto enforcement dropped by 40%. Then came the bombshell: on June 11, 2025, the SEC dropped its case against Coinbase. Not because Coinbase won in court. Not because the evidence disappeared. The SEC agreed to dismiss it - voluntarily. In a joint filing, they said they were exercising “discretion” and wanted to “renew” their approach. That’s code for: we’re changing direction.What’s the New Rule? Fraud Only

The new SEC isn’t ignoring crypto. They’re just narrowing their focus. Instead of chasing unregistered tokens, they’re going after clear fraud. In April 2025, they charged Ramil and PGI Global with a $198 million scam involving fake crypto and forex trading. In May, they went after Unicoin Inc. for lying about their token’s backing. But they dropped cases against firms accused only of failing to register as brokers or dealers. The message? If you’re honest, you’re not the target. If you’re lying, you’re still in deep trouble. This shift is huge. For years, exchanges had been scrambling to register tokens - often without clear guidance. Now, the SEC is saying: you don’t need to register every token. But you can’t lie to investors. You can’t promise returns you can’t deliver. You can’t run a rug pull. That’s the line now.

What This Means for Crypto in 2025 and Beyond

The $4.68 billion fine wasn’t the end of the story - it was the peak. The SEC’s aggressive phase is over. But that doesn’t mean crypto is safe. It means the rules are changing. Companies that spent millions trying to comply with unclear registration rules may now breathe easier. But those who thought they could get away with deception are in bigger danger than ever. The market is reacting. Bitcoin’s price crossed $100,000 in October 2025, with institutional investors returning after years of hesitation. Spot Bitcoin ETFs, approved in January 2024, are now handling billions in daily trading volume. The SEC’s new stance - focused on fraud, not registration - is making it easier for legitimate players to operate. But the uncertainty isn’t gone. No official guidance on token classification has been issued yet. No clear rules on what makes a token a security. The Crypto Task Force is still working. They’re talking about disclosure frameworks and registration paths. But until those documents land, everyone’s still guessing.What You Should Do Now

If you’re an investor: stick to platforms that are transparent. Avoid tokens that promise guaranteed returns. If it sounds too good to be true, it is - and the SEC will still go after it. If you’re building a crypto project: don’t rely on the old rules. Don’t assume everything is a security. But don’t assume nothing is either. Talk to a lawyer who understands the new SEC direction. Focus on honesty, not loopholes. If you’re just watching: the big crackdown is over. The real fight now is about clarity. The SEC isn’t going away. But they’re no longer trying to scare crypto into submission. They’re trying to build a system where it can grow - legally.Why did the SEC fine crypto companies $4.68 billion in 2024?

The $4.68 billion fine was mostly from one case: Terraform Labs and Do Kwon for running a fraudulent stablecoin scheme that collapsed and wiped out $40 billion in value. The SEC classified their tokens as unregistered securities, and the fine was the largest ever imposed on a crypto entity. Other cases, like Ripple and Telegram, added to the total, but Terraform made up the vast majority.

Did the SEC file more cases in 2024 than in previous years?

No. In fact, the SEC filed 33 crypto enforcement actions in 2024 - 30% fewer than in 2023. But they went after bigger targets with higher penalties. The drop in case count shows they shifted from volume to impact, focusing on the largest frauds and most significant violations.

Why did the SEC drop its case against Coinbase in 2025?

The SEC dismissed the case voluntarily as part of a broader policy shift after Gary Gensler left. The new leadership under Acting Chair Mark Uyeda decided to stop using enforcement to regulate crypto retroactively. Instead, they’re focusing on fraud and investor harm. The dismissal signaled that registration violations alone are no longer a priority.

Is crypto now legal under the SEC’s new approach?

It’s not about legality anymore - it’s about transparency. The SEC hasn’t legalized crypto. But they’ve stopped treating every token as a security. Now, they’re only going after clear fraud, market manipulation, or deception. If you’re honest and don’t mislead investors, you’re less likely to be targeted.

What’s the difference between the Gensler and Uyeda eras of SEC enforcement?

Gensler treated most crypto tokens as unregistered securities and used enforcement to force compliance. Uyeda’s team says that approach was too broad and reactive. They’re now focusing only on fraud and investor harm, dropping cases based on registration technicalities. Gensler wanted to control crypto through lawsuits. Uyeda wants to build rules so crypto can grow legally.

Will the SEC come back with more fines in 2026?

Probably not at the same level. The $4.68 billion fine was a one-time spike tied to Terraform and the end of Gensler’s term. The new approach is about steady, targeted enforcement - not massive penalties. Expect smaller fines for fraud, but no more billion-dollar blows unless another massive scam emerges.

Write a comment

Your email address will be restricted to us