Bali Token – Everything You Need to Know

When working with Bali Token, a utility token launched on the Binance Smart Chain that aims to bridge tourism services with crypto payments. Also known as BLT, it combines travel rewards with decentralized finance features, letting users earn and spend tokens across partner platforms.

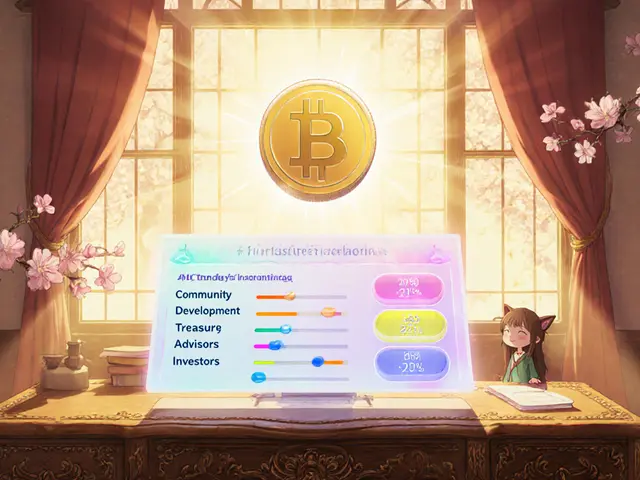

The core Tokenomics, covers a fixed supply of 100 million tokens, a 5% transaction tax split between liquidity, staking rewards and marketing, and a vesting schedule for the team that balances growth with investor protection. This design influences how the token behaves in the market and determines the incentives for holders to stake or provide liquidity.

Built on the Blockchain, specifically the Binance Smart Chain, Bali Token benefits from low fees, fast block times and compatibility with popular wallets like MetaMask and Trust Wallet. The chain’s proof‑of‑stake‑authority consensus also reduces energy use compared to older proof‑of‑work networks, making the token more appealing to eco‑conscious users.

The project kicked off with a Airdrop, that distributed 1 million BLT to early community members who completed simple social tasks, driving rapid awareness and a burst of initial trading volume. Since then, periodic reward campaigns have kept the community active and helped maintain liquidity on decentralized exchanges.

For traders, the token is listed on several Crypto Exchange, including PancakeSwap, ApeSwap and a few emerging centralized platforms that support BSC assets, each offering varying fee structures and staking options. Knowing which exchange matches your risk tolerance and fee preferences can save you money and improve execution speed.

Beyond the basics, Bali Token’s ecosystem includes travel‑booking dApps, NFT‑based souvenir collectibles, and a staking pool that rewards long‑term holders with additional BLT. These use‑cases create demand beyond pure speculation, linking token value to real‑world services.

Regulatory outlook matters too. While the token operates in a largely unregulated niche, its team follows KYC best practices for airdrop participants and strives for transparency in token distribution. Keeping an eye on jurisdictional updates helps you avoid unexpected compliance hurdles.

Now that you’ve got the lay of the land – from Bali Token fundamentals to how it’s traded and rewarded – scroll down to explore a curated list of articles that dig deeper into each of these topics, offer step‑by‑step guides, and share the latest market insights.

BALI TOKEN (BLI) Explained: What It Is, How It Works, and Where to Buy

Learn what BALI TOKEN (BLI) is, how it works on Ethereum and BSC, its use cases in Bali tourism, market data, buying steps, risks, and future outlook.