Institutional Cryptocurrency Restrictions

When dealing with institutional cryptocurrency restrictions, the set of rules that govern how banks, funds, and other large entities can trade, hold, or offer crypto assets. Also known as crypto compliance rules, they shape market access and risk management for professional investors.

KYC and AML compliance is a core pillar of these restrictions. Regulations require every transaction to be linked to a verified identity and to be screened for illicit activity. This means institutions must integrate sophisticated identity‑verification tools and continuous monitoring systems. The institutional cryptocurrency restrictions therefore push firms toward higher transparency, which in turn reduces the chances of money‑laundering and fraud.

Beyond KYC/AML, regulatory frameworks such as the U.S. SEC guidelines, the EU's MiCAR, and the FATF Travel Rule dictate what products can be offered and how they are reported. These frameworks influence institutional investors by defining capital requirements, custody standards, and disclosure obligations. In practice, a hedge fund that wants to add Bitcoin to its portfolio must first verify that its custodian meets the approved security standards and that its trading desk can handle the required audit trails.

Why Understanding These Rules Matters

Institutional cryptocurrency restrictions aren’t just paperwork; they affect the speed at which new products reach the market, the cost of compliance, and the overall confidence of the financial ecosystem. Firms that master these rules can launch crypto funds faster, attract more capital, and avoid costly regulatory penalties. Meanwhile, those that ignore them risk bans, fines, or damaged reputations.

Below you’ll find a curated set of articles that break down each aspect of crypto compliance—from global KYC/AML updates to real‑world case studies of institutional bans and approvals. Whether you’re a compliance officer, a fund manager, or just curious about how big players navigate the crypto space, the posts ahead provide the practical details you need to stay ahead of the curve.

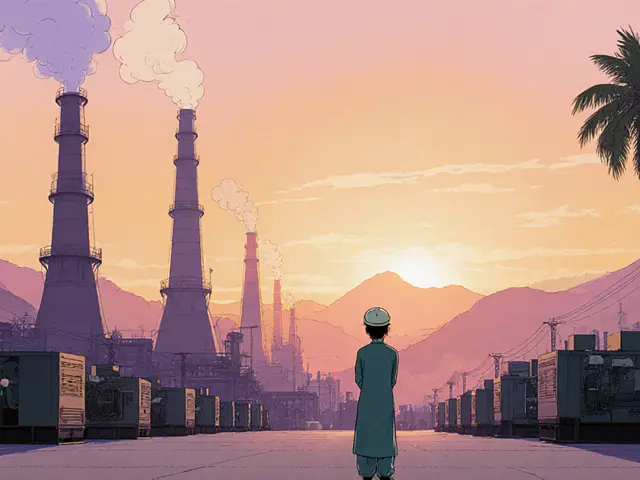

Qatar’s Institutional Crypto Ban: What It Means for the Financial Sector

An in‑depth look at Qatar's institutional crypto ban, what it means for banks, the limited digital‑assets sandbox, and how the Gulf region's regulations compare.