VPN Detection Risk: What It Means for Crypto Users

When working with VPN detection risk, the chance that a virtual private network usage is identified by services, regulators, or platforms, potentially leading to access blocks or compliance issues. Also known as VPN blocking risk, it affects anyone trying to hide their IP while trading or accessing crypto services.

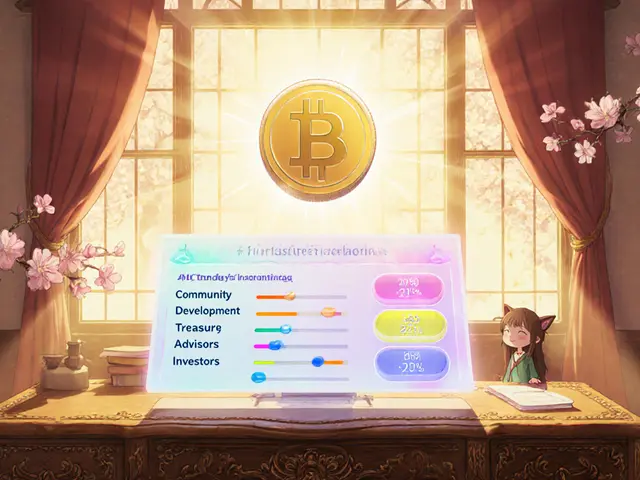

One major cousin of this risk is cryptocurrency compliance, the set of rules businesses follow to stay on the right side of regulators when handling digital assets. Linked directly, KYC/AML regulations, Know‑Your‑Customer and Anti‑Money‑Laundering mandates, require accurate IP data to verify a user’s true location. When a VPN masks that location, the detection systems trigger alerts, increasing the VPN detection risk for the user. In practice, exchanges and wallets rely on IP geolocation, technology that maps IP addresses to real‑world locations, to enforce regional rules. If the geolocation service spots an IP from a known VPN provider, the user may face account freezes, transaction limits, or outright bans.

Why does this matter today? The crypto world is scrambling to meet stricter global standards, and many jurisdictions treat VPN usage as a red flag for money‑laundering attempts. For example, recent FATF guidance pushes financial institutions to flag any transaction that appears to hide the originator’s true address. At the same time, decentralized finance platforms are adding layers of on‑chain analytics that can trace wallet activity back to an IP fingerprint. The result is a landscape where a single VPN connection can cause a cascade of compliance checks, slowing down trades and exposing users to legal scrutiny.

So, what can you do to lower the chance of being caught? First, pick a reputable VPN that rotates IPs infrequently and offers dedicated static addresses in regions where crypto services are allowed. Second, combine the VPN with a trusted identity verification provider that can supply proof‑of‑address documents matching the VPN’s location. Third, stay informed about the specific geo‑restrictions of each exchange—some block entire countries, while others only restrict certain activities like futures trading. Finally, keep an eye on any compliance alerts from the platforms you use; many now send email or in‑app notifications when a risk flag is raised.

Understanding how VPN detection risk interacts with compliance, KYC, and IP geolocation gives you a clearer roadmap to navigate the crypto space safely. Below you’ll find a curated set of articles that break down each piece in more detail, from practical VPN selection tips to deep dives on how regulators are shaping the future of crypto security. Dive in to see how these concepts play out across real‑world scenarios and learn the steps you can take right now to protect your digital assets.

How VPN Use Fuels Crypto Trading in Iran and the Rising Detection Risks

Explore how Iranian crypto traders rely on VPNs, the rising detection methods, enforcement actions in 2025, and practical ways to reduce risk while trading.