Crypterium (CRPT) Token Calculator

Token Supply Analysis

Total Supply: 95 million CRPT

Circulating Supply: 70 million CRPT

Transaction Fee Burn Rate: 0.5% per transaction

Transaction Fee: CRPT

CRPT Burned: CRPT

New Circulating Supply: CRPT

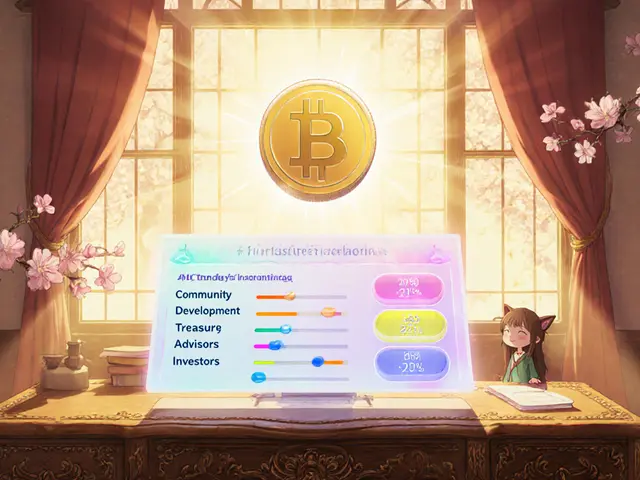

Token Distribution

Distribution Overview

How CRPT Deflation Works

Every time you make a payment with CRPT, 0.5% of the transaction value is automatically burned. This creates a deflationary effect that reduces the total supply over time.

With a total supply of 95 million CRPT and 70 million currently in circulation, each transaction burns a small portion of the token, potentially increasing scarcity and value.

Note: This calculator estimates theoretical effects. Actual burn rates depend on real-world transaction volume.

Crypterium (CRPT) is an ERC‑20 utility token built on the Ethereum blockchain that grants access to a mobile cryptobank and Visa‑linked payment card. Launched in 2017, the token powers a platform that lets users spend crypto at millions of NFC terminals and online merchants, all through a smartphone app.

Quick Facts

- Launch year: 2017 (ICO)

- Blockchain: Ethereum (ERC‑20)

- Total supply: 95million CRPT

- Current price (Oct2025): $0.0011-$0.0213 (low liquidity)

- Key utility: 0.5% transaction fee burned on every payment

How Crypterium Works

The platform is a mobile‑first cryptobank. After you buy CRPT, you load it into the app, then you can order a physical Visa card. When you pay in a store, the card converts your CRPT to fiat at the point of sale, so merchants see a normal Visa transaction.

Only users who hold CRPT can open an account, because the token is required to cover the 0.5% fee on every payment. Those fees are automatically burned, creating a deflationary pressure on the supply.

Tokenomics in Detail

The token distribution was designed to keep the community in control:

| Group | Allocation | Tokens |

|---|---|---|

| Community | 70% | 66.5million |

| Reserved Funding | 15% | 14.25million |

| Founders & Team | 9% | 8.55million |

| Advisors | 3% | 2.85million |

| Bounty Campaigns | 3% | 2.85million |

Every time you spend crypto, 0.5% of the transaction is taken in CRPT and removed from circulation. If usage spikes, the burning mechanism can shrink the circulating supply and theoretically lift the price.

Getting Started: Buying and Using CRPT

Because CRPT is not listed on many big exchanges, most newcomers turn to decentralized venues. The most liquid pair is CRPT/USDT on Uniswap V3. You’ll need an Ethereum‑compatible wallet (e.g., MetaMask) that can interact with the Uniswap interface.

- Connect your wallet to Uniswap V3.

- Select CRPT and USDT as the trading pair.

- Enter the amount you want, approve the transaction, and confirm.

- Transfer the received CRPT to the Crypterium app (the app shows a QR code for the deposit address).

- Order the Visa card inside the app and start spending.

Remember to keep a small CRPT balance for fees - each payment will burn a fraction of a token.

How Crypterium Stacks Up Against Competitors

| Token | Primary Platform | Card Integration | Deflationary Mechanic |

|---|---|---|---|

| Crypterium (CRPT) | Crypterium / Choise.com | Visa (physical & virtual) | 0.5% fee burned per transaction |

| Crypto.com (CRO) | Crypto.com App | Visa/Mastercard (Crypto.com Card) | Burn on staking & certain promos |

| Coinbase (COIN) | Coinbase Card | Visa (linked to Coinbase account) | No built‑in burn, relies on market demand |

| Binance (BNB) | Binance.com & Binance Card | Visa (limited regions) | Quarterly token burns from fees |

What makes Crypterium unique is the mandatory token‑holder model: you can’t use the card without holding CRPT. That creates a built‑in demand loop, something most competitors don’t require.

Risks, Criticisms, and Current Market Reality

Despite the clever design, CRPT faces three big challenges:

- Liquidity crunch: Prices differ wildly between Coinbase ($0.0213) and CoinGecko ($0.0011). Low daily volume means big slippage for traders.

- Brand confusion: The platform rebranded to Choise.com and introduced a new CHO token. Users often aren’t sure which token does what.

- Competitive pressure: Crypto.com, Coinbase, and traditional banks are all rolling out similar Visa cards with deeper marketing budgets.

Technical analysts note that as long as the cryptobank sees real spend, CRPT retains intrinsic utility. But with current trading volumes under $200 daily, the speculative upside looks limited.

Future Outlook: Will CRPT Bounce Back?

Two factors could tilt the needle:

- Growth in real‑world spend: If the user base expands and transaction volume climbs, the burn mechanism could noticeably shrink supply, nudging price upward.

- Clearer token ecosystem: A successful rollout of CHO‑based yield products without cannibalising CRPT’s core purpose would give investors a clearer story.

On the flip side, regulatory scrutiny of crypto‑linked Visa cards and the rise of central bank digital currencies could limit demand for private solutions like Crypterium.

For now, the safest view is to treat CRPT as a utility token rather than a speculative asset. If you need a crypto‑friendly Visa card and are comfortable navigating Uniswap, holding a modest amount of CRPT makes sense. Otherwise, keep an eye on the platform’s updates before committing large funds.

Frequently Asked Questions

What is the main purpose of the CRPT token?

CRPT is the access key for Crypterium’s mobile cryptobank and Visa card. It also pays a 0.5% fee on every payment, which is burned to create deflationary pressure.

How can I buy CRPT?

The easiest way is through Uniswap V3 using an Ethereum‑compatible wallet. Choose the CRPT/USDT pair, swap, then send the tokens to your Crypterium app.

Why does CRPT price vary so much between exchanges?

Liquidity is very thin. Small buy or sell orders can move the market, leading to large price gaps between platforms like Coinbase and CoinGecko.

What is the relationship between CRPT and the CHO token?

CRPT powers the original Crypterium services (banking, Visa card). CHO is a newer token introduced after the rebrand to Choise.com. CHO offers staking, yield farming, and NFT‑based rewards, but does not replace CRPT’s core utility.

Is Crypterium’s Visa card available worldwide?

The card is issued in most European countries and a few regions in Asia. Availability is expanding, but you should check the app for the latest list of supported jurisdictions.

Write a comment

Your email address will be restricted to us