Crypto Mining Subsidy: How Incentives Keep Blockchains Running

When you hear crypto mining subsidy, the financial incentive paid to miners for securing a blockchain network. It’s what keeps Bitcoin and other proof-of-work chains alive—without it, no one would bother running expensive hardware to verify transactions. This subsidy comes in two forms: block reward, the new coins created and awarded to miners for adding a block, and transaction fees, payments users add to get their transactions confirmed faster. Together, they form the economic engine of decentralized networks.

Right now, Bitcoin’s block reward is 3.125 BTC per block, but it cuts in half roughly every four years. That’s called the halving—and it’s why the subsidy is shrinking. As rewards drop, miners rely more on fees. Ethereum moved away from mining entirely, switching to proof-of-stake, which killed its subsidy model and replaced it with validator rewards. Meanwhile, chains like Bitcoin Cash and Litecoin still run on mining subsidies, but their smaller networks mean less security and more volatility. In places like Kazakhstan, where energy costs dropped and mining boomed, governments started banning it because the grid couldn’t handle the load. That’s the real-world tension: subsidy drives adoption, but too much can break infrastructure.

What does this mean for you? If you’re holding Bitcoin, you’re benefiting from a system designed to slowly reduce new coin supply. If you’re mining, you’re watching your income shift from fresh coins to user-paid fees. And if you’re just using crypto, you’re indirectly paying for security through those fees. The posts below dig into how this system works in practice—from how miners calculate profits, to why some projects are ditching mining altogether, to what happens when subsidies disappear. You’ll find real breakdowns of block rewards on Bitcoin and Ethereum, how transaction fees behave under pressure, and why some crypto exchanges now warn about mining-linked coins. This isn’t theory. It’s the money behind every transaction you make.

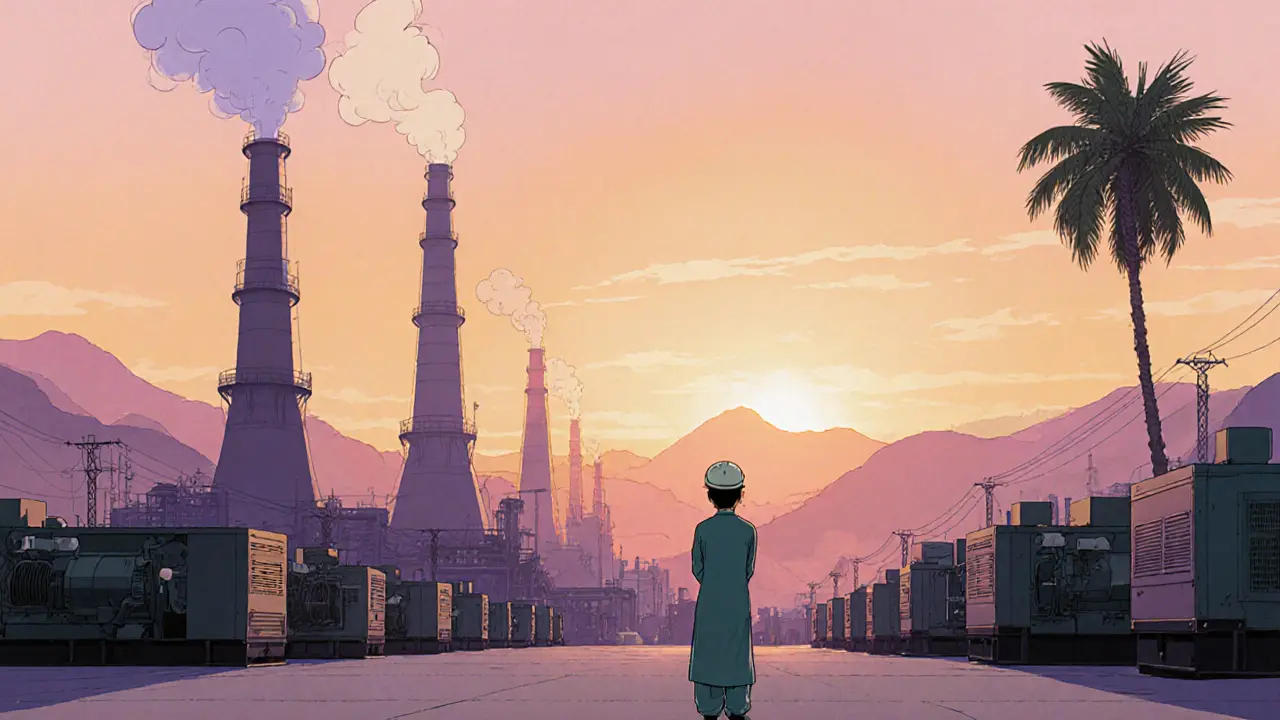

Pakistan Allocates 2,000 MW Power for Crypto Mining - What It Means

Pakistan's 2,000 MW power allocation for crypto mining aims to turn surplus electricity into a multi‑billion‑dollar industry, but it faces IMF scrutiny, subsidy concerns, and regulatory challenges.