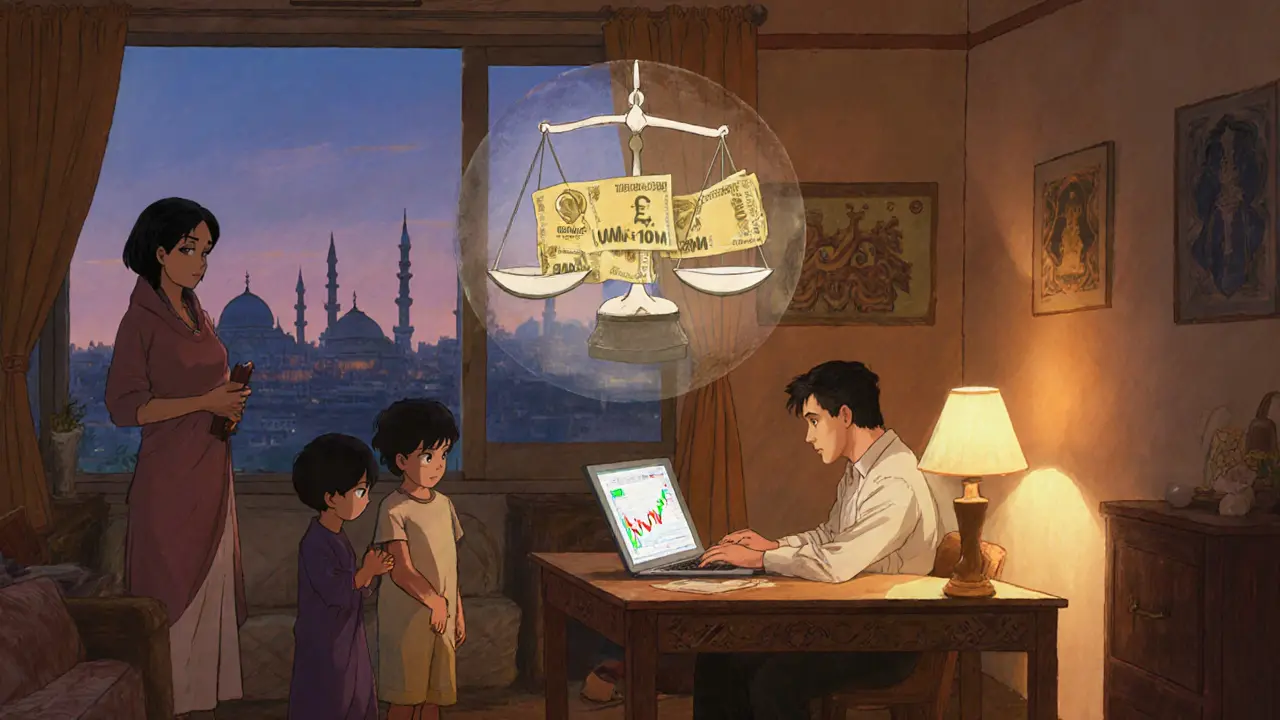

Egypt Cryptocurrency Fines – Key Insights

When dealing with Egypt cryptocurrency fines, penalties imposed by Egyptian authorities on crypto activities that break local rules. Also known as Egypt crypto penalties, they signal how seriously the government watches digital money.

These fines are a part of the broader crypto regulation, the set of laws, licences and enforcement actions that shape how digital assets can be used in Egypt. Crypto regulation requires businesses to register, keep records and report suspicious activity. In practice, the regulator’s focus is on preventing money‑laundering, protecting consumers and ensuring tax compliance.

Why the fines matter for traders and projects

First, Egypt cryptocurrency fines can wipe out months of profit in a single compliance slip. Second, they serve as a warning sign for anyone thinking about launching a token or exchange in the region. The government's approach mirrors global trends: strict AML/KYC requirements, obligations for identity verification and transaction monitoring are the backbone of enforcement. If a platform skips these steps, the penalty can reach six figures in Egyptian pounds.

Third, the fines influence how crypto exchanges operate. Local exchanges must obtain a licence, submit regular audit reports and enforce limits on trade volume. Failure to meet these standards triggers exchange‑specific penalties, often referred to as crypto exchange penalties, financial sanctions applied when an exchange violates licensing or operational rules. These penalties can include suspension of services, mandatory asset freezes, or outright closure.

Fourth, tax obligations tie directly into the fine structure. Egypt treats crypto gains as taxable income, and the tax authority expects accurate reporting. When traders under‑report or ignore tax filings, they face additional fines that compound the regulatory ones. This double‑layered risk pushes investors to adopt proper bookkeeping and use compliant wallets.

Fifth, the legal environment affects airdrop projects. Although airdrops are popular for community growth, they can trigger tax events and AML scrutiny if the tokens are distributed without proper user verification. Projects that ignore these rules may see their airdrop campaigns halted and their teams fined.

All these pieces—regulation, AML/KYC, exchange rules, tax duties, and airdrop compliance—form a network of checks. The central idea is that Egypt cryptocurrency fines are not isolated; they are the enforcement arm of a larger compliance ecosystem. Understanding each link helps you avoid costly mistakes.

Below you’ll find a curated set of articles that break down each aspect in plain language. From how to set up KYC procedures to what tax forms you need, the collection gives you actionable steps to stay on the right side of the law while still participating in the crypto market.

Egypt’s 1‑10MillionEGP Fines for Crypto Trading: What the Law Says

Egypt imposes 1‑10millionEGP fines for crypto trading under LawNo.194of2020. Learn the penalties, enforcement agencies, and how the ban clashes with high local crypto use.