Taliban Crypto Ban: Impact and What It Means for Digital Assets

When talking about the Taliban crypto ban, most people picture a sudden clampdown on Bitcoin, Ethereum and any online token trading inside Afghanistan. Taliban crypto ban, the policy imposed by Afghanistan's Taliban regime that restricts the use, trading, and mining of cryptocurrencies within its territory. Also known as Taliban cryptocurrency restriction, it aims to prevent capital flight, curb illicit financing and retain control over the monetary system. This move is part of broader cryptocurrency regulation, government policies that control or limit digital‑asset activities trends we see across the globe, from Kazakhstan’s power‑grid‑driven mining bans to Argentina’s banking restrictions.

How Related Policies Shape the Landscape

One key piece of the puzzle is crypto mining bans, government orders that stop or limit proof‑of‑work mining operations for environmental or security reasons. In Kazakhstan, a fragile energy grid forced the government to cap mining power, while the Taliban’s decree targets both exchanges and local mining rigs to avoid unregulated wealth flows. Another pillar is KYC & AML requirements, know‑your‑customer and anti‑money‑laundering rules that force crypto platforms to verify users and report suspicious activity. These rules help authorities enforce bans, because without proper identity checks, illicit transfers slip through the cracks.

Putting it together, the Taliban crypto ban encompasses restriction of exchanges, prohibition of mining, and tightening of KYC/AML standards. It shows how a single government can influence a whole ecosystem: users lose access to local wallets, miners shut down rigs, and international platforms must decide whether to serve a high‑risk market. At the same time, the ban feeds into a larger narrative about digital‑asset sovereignty – a theme echoed in El Salvador’s Bitcoin‑as‑legal‑tender experiment and the U.S. Treasury’s travel‑rule push.

Understanding these connections helps you see why a crypto ban isn’t just a news headline; it’s a cascade of policy, technology and compliance decisions that ripple across borders. Below you’ll find a curated collection of articles that break down diversification strategies, blockchain immutability, regional crypto regulations, and real‑world case studies, giving you practical insight into how bans like the Taliban’s shape the market today.

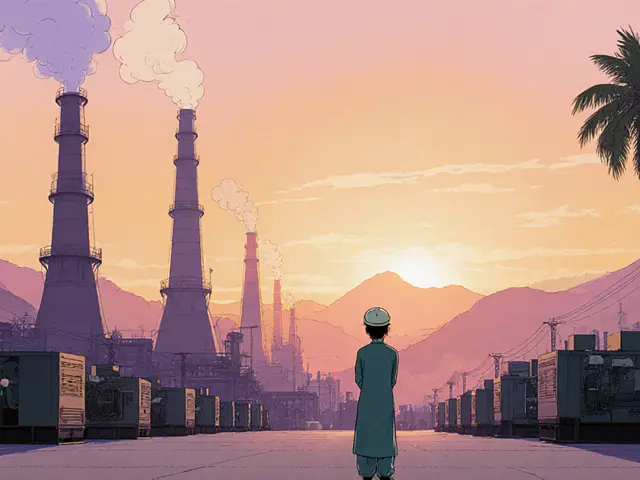

Taliban Crypto Ban Explained: Sharia Law View on Bitcoin

The Taliban's absolute crypto ban stems from a strict Sharia interpretation, targeting Bitcoin and all digital assets. This article breaks down the religious reasoning, enforcement, underground workarounds, and future outlook for crypto in Afghanistan.